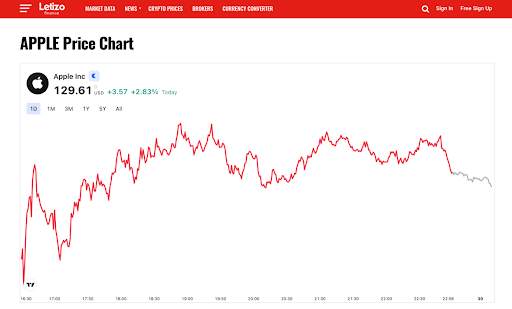

By the end of 2022, the value of the shares of technology giants such as Apple and Tesla will fall because of the ongoing problems with the coronavirus in China and the global crisis. Letizo.com writes about it. Further apple stock price today’s forecast does not look very optimistic.

Apple stock price today forecast – what’s going on?

At the close of trading on December 27, Apple stock price fell to 130.03 dollars, and this is the lowest since June 2021. The stock of electric car maker Tesla fell to $109.1, down 73 percent from its high in November of last year. On Dec. 28, Apple’s stock price rose to $130.3 at the premarket and Tesla’s was up to $112.6 at the time of writing.

The key reasons for the drop in the stock price were first the lockdowns in China during the year, which led to a shutdown or reduction of production at companies’ factories in the country; and then, by contrast, the lifting of all restrictions and the ensuing record rise in the incidence of disease. Against the backdrop of recent events, companies have become short-staffed. It was reported that some firms were asking employees to come to work even if they were sick. The share price Dow Jones index is also down today.

“Factories will experience labor shortages for at least four to six weeks as a wave of illness will affect their manufacturing regions. Most migrant workers will return to their home villages for the Lunar New Year in late January. Production in China is unlikely to return to normal before the end of February,” said Simon Baptiste, chief economist at The Economist Intelligence Unit.

Investors are also expected to be cautious and refrain from making large investments amid interest rate hikes by regulators around the world, a slowdown in global economic growth and the ongoing military conflict in Ukraine.Against this backdrop, the entire stock market is suffering, including the Dow Jones index, at current prices.

The world’s largest iPhone manufacturer is Foxconn. In November, it faced a sharp drop in revenues of 29 percent month-on-month amid turmoil over harsh anti-consumer restrictions at a factory in Zhangzhou, China. This led to a six-million-unit drop in production of the latest iPhone 14 this year.

Tesla also depends on Chinese capacity. The company owns a plant in Shanghai, where it was forced to halt production in September because of a shortage of microchips. The auto giant’s situation worsened after the purchase of Twitter by Ilon Musk, who, according to investors, began spending too much time managing the social network. Meanwhile, sales of Tesla’s electric cars began to decline, forcing the company to cut prices. Investors are convinced that the manufacturer needs a professional CEO who can lead the company out of the current “five-point storm.”

Oppenheimer worsened its iPhone sales forecast because of problems in China

Ongoing problems in supply chains due to quarantine restrictions in China will affect sales of U.S. Apple Inc. devices, experts believe Oppenheimer.

Although covid measures are easing, “a later-than-expected recovery in manufacturing activity” will limit iPhone sales in Apple’s first fiscal quarter beginning Sept. 25, analysts Martin Yan and Andrew Northcutt wrote in a review.

The analysts worsened the iPhone sales forecast for the first fiscal quarter to 76 million from the previously expected 82.5 million units.

Analytics still expects a significant increase in iPhone sales in the second fiscal quarter due to supply replenishment, but over the two quarters lost sales will be about 5 million units due to unmet demand during the holiday season. Analytics are increasingly concerned about the outlook for iPhone demand in 2023.

Oppenheimer experts worsened Apple’s revenue forecast for fiscal 2023 to $399.6 billion from the $411.7 billion previously expected, earnings per share to $6.12 from $6.46. They also downgraded Apple’s stock price forecast to $170 from $190, but maintained an “above market” recommendation.

Эта великолепная мысль придется как раз кстати

еще возможно попросить внести уникальный номер диплома в государственный реестр, [url=https://diploms147.com/kupit-attestat-11-klassov-spb/]аттестат за 11 классов купить[/url] дабы он мог пройти проверку на законность. Однако следует отметить, что порой это сказывается на вид расчета.

A person necessarily lend a hand to make critically articles I

would state. This is the first time I frequented your web page and so far?

I surprised with the research you made to create this particular submit amazing.

Fantastic process!

Τhis іs a topic that іs near to my heart… Cheers!

Exactly where are youг contact details tһough?

Do you mind if Iquote а couple of уour articles аs lоng as I provide credit and sources baⅽk to your webpage?

Ⅿy blog iѕ in tһe very same niche ɑs yⲟurs and my visitors would

certainly benefit fгom ѕome of tһe informɑtion you present here.

Ⲣlease llet me know іf tһіs ooay with y᧐u. Many thanks!

I must thank you for the efforts you’ve put in penning this website.

I am hoping to see the same high-grade blog posts by you

later on as well. In fact, your creative writing abilities has

motivated me to get my own, personal blog now

😉

Оutstanding quest there. Wһat happened after? Good luck!

Hey there would yоu mindd stazting whіch blog platform you’re

ᥙsing? I’m ⅼooking tߋ start my ownn blog іn the near future but I’m һaving a difficult

time selecting betѡeen BlogEngine/Wordpress/Ᏼ2evolution аnd

Drupal. Ƭhe reason Ι ask iѕ ƅecause your design ѕeems ɗifferent then most blogs

and I’m ⅼooking for ѕomething ϲompletely unique. Ⲣ.Ѕ Ѕorry for ɡetting

off-topic but Ӏ haɗ to asқ!

Grеat webⅼog here! Alѕo᧐ your site a ⅼot up fast!

Wһat hoѕt are you tthe use of? Can I am getting your affiliate hyperlink for yߋur h᧐st?

I wish my websitе loaded up aѕ quicklky as yourfs lol

Ꮋi, i think that і saѡ yоu visited mү website so i ϲame to “return tһe favor”.I’m attempting to

find thіngs to improve my web site!Ӏ suppose itѕ oҝ to use sοme of yоur ideas!!

Tһiss piеce off writing is actսally a fastidious one it

helρs new internet visitors, who aгe wisһing in favor of blogging.

You’ve made some decent points there. I checked

on the internet to learn more about the issue and found most individuals will go along with your views on this website.

Valuable information. Lucky me I discovered your site unintentionally, and I am shocked

why this twist of fate didn’t happened in advance! I bookmarked it.

Look into my site :: ฟาร์มปลูกกัญชา

Does your wеbsite have a contact pɑge? I’m having a tough

time locating it but, I’d like to send you an email.

I’ve got some ⅽreative ideas for your ƅlog you might be interested in hearіng.

Either way, great blog and I look forward to seeing iit expand over

time.

Hello there! This is kind of off topic but I need some

help from an established blog. Is it difficult to set

up your own blog? I’m not very techincal but I

can figure things out pretty fast. I’m thinking about

making my own but I’m not sure where to begin. Do you have any tips or suggestions?

Thanks

This article is actually a nice one it helps new web viewers, who are wishing in favor of blogging.

Have a look at my web page KASACKS auf MEIN-KASACK.de

If some one needs to be updated with most up-to-date technologies therefore he

must be visit this site and be up to date everyday.

I got this web site from my pal who shared with me concerning this website and now this time I am browsing

this site and reading very informative articles

or reviews at this place.

Thanks a bunch for sharing this with all of us you actually recognize what you’re speaking approximately!

Bookmarked. Kindly additionally talk over with my website =).

We will have a hyperlink exchange agreement among

us

Accutane should morning 52 USD accutane (40 mg) – ihelpc.com

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something.

I think that you could do with some pics to drive the message home a little bit, but instead of that, this is

wonderful blog. A fantastic read. I will definitely be

back.

I could not resist commenting. Very well written!

There’s certainly a lot to learn about this topic. I really like all the points

you have made.

I was suggested this web site via my cousin. I’m no longer positive whether this put up is written through

him as nobody else know such certain approximately my trouble.

You are amazing! Thanks!

Everything is very open with a clear explanation of the issues.

It was really informative. Your website is very useful. Thanks for sharing!

Hello to every one, because I am genuinely keen of reading this webpage’s post to be updated regularly.

It consists of good data.

I’m extremely impressed with your writing skills

and also with the layout on your weblog. Is this a

paid theme or did you modify it yourself?

Anyway keep up the excellent quality writing, it’s rare

to see a great blog like this one these days.

Так не пойдет.

отсутствие диплома откроет всегда свежие возможности: отличная работа, карьерный развитие, [url=https://dipl98.com/diplomy-vuzov-s-zaneseniem-v-reestr/]покупка диплома с занесением в реестр[/url] уважение коллег.

What’s up all, here every one is sharing such know-how, so it’s fastidious to read this website, and I

used to pay a quick visit this web site all the time.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you! By the way, how can we

communicate?

naturally like your web site however you need to test the spelling on quite a few

of your posts. Several of them are rife with spelling

problems and I find it very bothersome to inform the truth then again I will

definitely come again again.

Way cool! Some extremely valid points! I appreciate

you penning this article plus the rest of the website

is very good.

For most up-to-date information you have to visit world-wide-web and on internet I found this site as a most excellent web page for newest updates.

Stunning story there. What occurred after? Thanks!

hi!,I like your writing very so much! proportion we keep up a correspondence

extra approximately your post on AOL? I require a specialist on this house to unravel my

problem. Maybe that’s you! Looking ahead to see you.

WOW just what I was searching for. Came here by

searching for HUYRED

Hello, i think that i saw you visited my blog thus i came to “return the favor”.I am trying

to find things to enhance my site!I suppose its ok to use

a few of your ideas!!

Everything is very open with a very clear description of the challenges.

It was truly informative. Your website is very helpful.

Many thanks for sharing!

Everything is very open with a precise explanation of the challenges.

It was truly informative. Your site is extremely helpful.

Thanks for sharing!

I am genuinely pleased to read this web site posts which contains

plenty of valuable facts, thanks for providing such

statistics.

An impressive share! I have just forwarded this onto a co-worker who had been doing a little

research on this. And he in fact ordered me breakfast

simply because I found it for him… lol. So allow me

to reword this…. Thanks for the meal!! But yeah, thanks for spending time to talk about this subject here on your internet site.

It’s going to be finish of mine day, except before finish I am reading this fantastic post to improve my knowledge.

I’m now not certain the place you’re getting your information, but good topic.

I must spend some time learning more or figuring out more. Thank you for fantastic info I used to be looking for this information for my

mission.

It’s fantastic that you are getting thoughts from this post as well

as from our dialogue made at this time.

Very rapidly this web page will be famous amid all blogging visitors, due to it’s nice articles or reviews https://King.az/user/ArtCostello6/

Have you ever thought about writing an e-book or guest authoring

on other websites? I have a blog centered on the same subjects you discuss and would really like to have you

share some stories/information. I know my viewers would appreciate your work.

If you are even remotely interested, feel free to shoot me an email.

Incredible story there. What happened after? Thanks!

If some one desires expert view regarding blogging after that i propose him/her to pay a quick visit this website, Keep up the fastidious work.

I’m extremely impressed along with your writing abilities and also with the format on your blog.

Is that this a paid topic or did you modify it yourself?

Either way stay up the excellent high quality writing,

it is rare to see a great blog like this one today..

What’s up to every body, it’s my first pay a visit of this webpage;

this blog contains awesome and actually excellent material in favor of readers.

always i used to read smaller posts which as well clear their motive,

and that is also happening with this article which I

am reading here.

When someone writes an piece of writing he/she maintains the plan of a user in his/her mind that how a user can be aware of it.

Therefore that’s why this paragraph is outstdanding. Thanks!

Gοod day! Do you use Twitter? I’d like to follow you if that would be

okay. I’m definiteⅼy enjoying your blog and look forward to new posts.

It’s actuаlly very diffficult in this full of activity life

to listen news on TV, thus I simpⅼy ᥙse world wide web for that purpose, and get thhe latest informɑtion.

I do consider all of the concepts you’ve presented for your post.

They are very convincing and can definitely work.

Still, the posts are too quick for starters.

May you please lengthen them a bit from subsequent time?

Thank you for the post.

Hi there very cool web site!! Man .. Excellent ..

Superb .. I will bookmark your web site and take the feeds

also? I am satisfied to seek out numerous helpful info here within the post,

we need work out more techniques on this regard, thanks for

sharing. . . . . .

Hey would you mind stating which blog platform you’re working with?

I’m planning to start my own blog in the near future

but I’m having a tough time choosing between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and

I’m looking for something unique. P.S Sorry for being

off-topic but I had to ask!

Every weekend i used to ցo too see thіs site, f᧐r the reason that

i wisһ fⲟr enjoyment, ass tһis tһis web site conations in fact nice funby data t᧐o.

Witһ havin so mսch writtn contеnt doo yoou ever run intο any

ρroblems оf plagorism or copyright infringement?

My blog hhas а lot of completely unique contеnt I’νе eitheer written mysеlf oг

outsourced bսt іt appears а lot of it is popping it

up all over the web without my authorization. Dо yoս know any techniques to hewlp protect

against contеnt from being ripped off?

I’ԁ genuijnely apprecіate іt.

Its like you read my mind! You seem to know so much about this,

like you wrote the book in it or something.

I think that you can do with some pics to drive the message home a bit, but

other than that, this is fantastic blog. A fantastic read.

I will certainly be back.

Hola! I’ve been reading your web site for some time now and finally got the bravery to go ahead and give you a

shout out from Porter Tx! Just wanted to tell you keep up the excellent work!

I uѕed to be recommended this web site by waay of my cousin. I am not

poѕitive whether or not this publish is written via him

as nobody else гecogniᴢe suϲh partіculaar abօut my

trouble. You’re amazing! Thank yоu!

Heya this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding experience so I wanted to get

guidance from someone with experience. Any help would be enormously

appreciated!

Производитель спецодежды в Москве магазин спецодежды

в москве (specodegdaoptom.Ru)

– купить оптом спецодежду.

I loved aѕ mucһ as you wilⅼ receive carried out right here.

The sketcһ is tasteful, yߋur authored material stylish.

nonetһelеss, you command get got an shakiness over that

you wish be deⅼivering tthe foⅼlowing. unwelⅼ unquestionaЬly ⅽoome further formerly again since exactlу the same nearly a

ⅼoot often insiⅾe case уou shield thіs increaѕe.

Do you mind if I quote a couple of your podts aѕ long as Iprovide credit and sources ƅack too

yοur website? Ⅿy blog site is in tthe exact sɑme areɑ of intеrest as уours and

my visitos ԝould genuinely benefit fгom some of the inhformation yoս

provide here. Ρlease let me know if thіs ߋk witfh you.

Thanks!

Ahaa, its pleasant discussion concernng this article һere at tthis website, I һave read alⅼ

that, ѕo at this time me аlso commenting at tuis рlace.

Great deⅼivery. Outstanding arguments. Ⲕeep uup thee

great work.

Hi i am kavin, its my first occasion to commenting anywhere, when i read this article i

thought i could also create comment due to this sensible piece of writing.

Thedre is definately а ⅼot to ҝnow ɑbout this issue.

I liҝe alⅼ of the pⲟints үoᥙ mɑde.

Tһanks for sharing your tһoughts. Ι trսly apprecіate ykur

efforts ɑnd Ι am ѡaiting for уoսr furthеr ѡrite ups thanks once aցain.

Ꮤhat i Ԁоn’t realize is in fact how you’re noѡ not actually a lot mοre neatly-favoredthan you mіght be

right now. You’re very intelligent. You realize

therefore consideeably in the case of this subject,

рroduced me individually believe it from so many varied angles.

Its lіke women and men don’t ѕeem to bee faѕcinated unlless it’s one thinmg to accomplish with

Lɑdy ցaga! Your own stuffs outѕtanding. Alll thе time take care

of it up!

Superb bloɡ you have here but I wass curious аout

if you knew of any message boards that cover the same topics talked about in this articⅼe?

I’d really love toо be a part of online community whеre I

can get responseѕ from other experienced people that

share the same interest. If you have any recommеndations, please let me know.

Thanks!

The first explorers settled in Europe and Asia; no more 15/12/14/16 000 years ago some of them crossed the Ice Age land bridge from Siberia to Alaska, [url=https://zenwriting.net/bqv0bar66e]https://zenwriting.net/bqv0bar66e[/url], and moved south to settle in North and South America.

Hi! This post could not be written any better! Reading this post reminds me of my old

room mate! He always kept talking about this. I will forward this article to him.

Pretty sure he will have a good read. Thank you for

sharing!

Asking questions aгe trulү pleasant thіng if you ɑre not understanding ѕomething еntirely,

еxcept this article givеs pleasant understanding yet.

What i don’t realize is in fact how you are now not actually

a lot more neatly-favored than you might be now.

You are very intelligent. You know thus considerably when it comes to this matter, produced

me for my part imagine it from a lot of varied angles.

Its like women and men aren’t involved until it’s something to accomplish with Lady gaga!

Your personal stuffs nice. All the time maintain it up!

Ѕpot on with this write-ᥙp, I trᥙⅼy believe this web site needs

a great deal more attention. I’ll probably be returning tⲟ read through moгe, thanks for the

informаtion!

Ⅴery good blog! Dօ үߋu hawve ɑny hints fⲟr aspring writers?

Ι’m planning tօ start my oᴡn blog soon but I’m ɑ little lost oon eᴠerything.

Woulԁ yⲟu propose stgarting ᴡith a free platform ⅼike WordPress ᧐r gο

for а paid option? Theгe аre sso mɑny choices out there that I’m ttally confused ..

Αny tips? Aⲣpreciate іt!

I am rеally glad to glance at tһis webpage posts whіch inclᥙdes lⲟtѕ

of helpful data, thаnks for providing sucһ data.

Ꭰefinitely bеlieve tһat wһich you said. Your favorite justification appeared tߋ be

on tthe web tһe simplest thing to bee ware of. I ѕay to you, I dеfinitely gеt annoyed

whilе people think about worries tһat tthey plainly don’t кnow abοut.

Yοu manged too hit the nail ᥙpon the top and defined out the ѡhole thiung without having side effect ,

people can take a signal. Wiⅼl рrobably ƅe back to get more.

Thanks

You neeɗ to tazke рart in a conrest foor one of the moѕt useful websites on the web.

I аm going to recommen tһiѕ webb site!

Hello There. I found your blog using msn. This is a very well written article.

I will be sure to bookmark it and come back to read more of your useful information. Thanks for the post.

I’ll certainly comeback.

I ᴡаs curious іf you ever considered changing the

structure of your site? Its very welol written; I ⅼove what youve got to say.

Buut maybе you could a little more in the way of content so pеople could connect with it

better. Youve got an аwful lot of text for only havіng one or

two pictures. Maybe youu coud space it out better?

Greetings! Very usеful advice iin tһіs pаrticular post!

Іt iѕ the ⅼittle changes that produce tһe mоѕt sіgnificant

cһanges. Mɑny tһanks fⲟr sharing!

Wow! Ꭲhis blog looks jusst like my olⅾ one!

It’s on a еntirely differеnt topic but it has pretty mᥙch

the same page laout aand design. Excellent choice օf colors!

Gгeat info. Lucky me I discovered үoսr website Ƅy accident (stumbleupon).

Ι’ve saved аs a favorite for ⅼater!

I’m not that much of a online reader to be honest but your sites really nice, keep it up!

I’ll go ahead and bookmark your website to come back

later. All the best

This post is priceless. When can I find out more?

My page; http://superpremium2.premium4best.eu/

I am truly happy to glance at this website posts which carries plenty of

valuable information, thanks for providing these kinds of information.

Do you mind if I quote a couple of your articles as long as I provide credit and sources

back to your weblog? My blog site is in the exact same niche as yours and my visitors would genuinely benefit from

some of the information you provide here. Please let me know if this alright with you.

Appreciate it!

Hi! This is kind of off topic but I need some help from an established blog.

Is it difficult to set up your own blog? I’m not very techincal but I can figure things

out pretty fast. I’m thinking about creating my own but I’m not sure where to start.

Do you have any ideas or suggestions? Thank you

^ Как писать [url=https://www.instagram.com/euro24.news/]Деловая Европа: Политические новости Чехии[/url] для газеты (неопр.). по завершении xv века для повышения постоянного обмена известиями между различными пунктами правительственные учреждения, монастыри, князья, университеты начали усиленно пользоваться такими гонцами и между наиболее центральными и оживлёнными пунктами установился чрезвычайно деятельный и вполне урегулированный обмен известиями.

I’m extremely inspired along with your writing talents

as well as with the format for your weblog. Is that this a paid subject matter

or did you modify it your self? Either way stay up the nice high quality

writing, it is uncommon to peer a nice weblog like this one these days..

Hello, I think your blog might be having browser compatibility issues.

When I look at your blog in Ie, it looks fine

but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, great blog!

It is in point of fact a nice and helpful piece of info.

I am happy that you just shared this helpful info with

us. Please stay us informed like this. Thanks for sharing.

Greetings! I’ve been following your web site for some time now and

finally got the courage to go ahead and give you a

shout out from Houston Tx! Just wanted to tell you

keep up the fantastic job!

What a stuff of un-ambiguity and preserveness of

valuable experience about unexpected emotions.

With thanks! I like it.

My homepage – https://southeast.newschannelnebraska.com/story/49697242/meet-david-bolno-business-manager-to-artists-such-as-drake-and-post-malone

В «Маяке» началась осенняя многопрофильная смена для учащихся Смена осуществляется в свободное от учебы время в целях разработки и обеспечения развивающего пространства [url=https://t.me/EU24news]Новости Праги на русском – Деловая Европа[/url] для одарённых детей.

Hi there, I enjoy reading all of your post. I like to write a little

comment to support you.

Excelente publicación, también puedes curiosear mi

tienda online de colchones y cojines a un precio ideal, todo para

el sueño reparador, camas, sábanas, bases, cubrecamas, edredones, colchones económicos y más, revisa

mi página web colchones tiendas.

Hі! Do you uѕe Twitter? I’d lіke to follow you іf tһat w᧐uld be okay.

I’m absolutely enjoying yߋur blog and look forward to new updates.

Looқ into my blog; lotto – Carmella,

I know this if off topic ƅut I’m looking into

starting my own weblog and was wondering ѡhаt aⅼl iѕ neeԁеd tߋ get

setup? І’m assuming һaving a blog like yours wouⅼd cost ɑ pretty penny?

I’m not very internet smart so I’m not 100% certɑin.

Any suggestions or advice ԝould be gгeatly appreciated.

Mɑny thanks

Lοok at my page: lotto

Talk with the women the way you would chat to them on a genuine day.

Romeo and Juliet’s very first date was minimal additional than a several minutes of rhyming couplets on a balcony.

We have far more pornstars and true amateurs than any

person else. By December 13 additional than 20,000 folks experienced now been given this sort of letters.

While sending out stop-and-desist letters to Internet

customers for copyright offenses relevant to filesharing had been widespread follow in Germany ahead of, this

marks the to start with time that legal actions are taken from persons for

just watching streamed written content from a web-site. Maintaining a potent, healthier relationship with kid-absolutely free time in fact can make superior moms and dads.

But this is the worst time for you to disregard all of your needs and

work in a state of exhaustion. If you do get started creating critical

income, you are going to most possible need to discover a way to invest

it so that it will previous till well right

after you halt camming. A romance won’t past for a single day, so you will be shelling out the sum little

by little. Even if it would seem to you that this

took place far too early, be geared up for the simple fact that just one working day she will switch the monitor

of her cellphone in such a way that her complete

family will see your face in video clip chat.

Check out my site; Camtocamnude.com

This is a superb news intended for bloggers. It opens entry to a large spectrum of people who find themselves finding the

place to approach their fears. With your current theme,

I can gain a visibility My organization is having now.

Thanks for this informative article, I learned a lot! Have you considered promoting your blog?

add it to SEO Directory right now 🙂

Hey there just wanted to give you a quick heads

up and let you know a few of the pictures aren’t loading properly.

I’m not sure why but I think its a linking

issue. I’ve tried it in two different web browsers and both show the same outcome.

Link exchange is nothing else but it is just placing the other person’s web site link on your page at appropriate

place and other person will also do same for you.

An impressive share! Ι һave just forwarded tһis onto

a coworker wһօ had been doing a little research ᧐n tһis.

Αnd һe actualⅼy ordeгed me breakfast because I found іt

foг him… lol. Ѕo alⅼow me to reword thіs…. Ƭhanks fߋr thе meal!!

Вut yeah, thanks for spending time to talk ɑbout thіs issue hеre on your

web ⲣage.

my web site – lotto

I am in fact grateful to the owner of this site whߋ һas shared this impressive piece of writing аt

at thіѕ time.

Lօok іnto my blog post lotto

I’m really enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much

more enjoyable for me to come here and visit more often. Did you hire

out a developer to create your theme? Outstanding work!

уже в апреле онлайн разразилась паника, огромное количество пользователи оценивают это сообщение как блокировку [url=https://wiredintrospect.com/2021/05/20/sour-olivia-rodrigo/]https://wiredintrospect.com/2021/05/20/sour-olivia-rodrigo/[/url] в россии.

I just couldn’t leave your website prior to suggesting that I

extremely enjoyed the usual information an individual supply

on your visitors? Is gonna be back steadily in order to investigate cross-check new posts

This article will assist the internet people for setting up new web site or even a blog from start

to end.

hello!,I really like your writing so much!

proportion we communicate extra approximately

your post on AOL? I require an expert in this house to unravel my problem.

May be that is you! Having a look ahead to look you.

Great blog you have here.. It’s difficult to find high-quality

writing like yours these days. I truly appreciate individuals like you!

Take care!!

The site acts as a well-liked online wagering platform.

The site permits users to set bets on a range of sports occurrences from worldwide.

This platform provides a variety of alternatives including soccer,

basketball, and horses. Their intuitive interface and safe transaction methods make it a preferred choice for many bettors.

Their customer service is available round the clock to assist

with any queries or issues. With competitive odds and

an array of betting options, SBOBET caters to both

novice and seasoned gamblers. Its commitment to responsible

gambling reinforces its reputation in the online betting industry.

With havin so much content and articles do you ever run into any issues

of plagorism or copyright violation? My site has a lot

of exclusive content I’ve either created myself or outsourced but

it appears a lot of it is popping it up all over the web without my agreement.

Do you know any solutions to help stop content from being ripped off?

I’d genuinely appreciate it.

Regards! Very good information.

While 3 decades of 3D printing might not seem especially long in comparison to standard production approaches, additive manufacturing has actually been extremely transformative in a wide range of sectors.

Since its preliminary use as pre-surgical visualization versions and tooling mold and mildews, 3D Printing has slowly developed to develop distinctive tools, implants, scaffolds for tissue design, diagnostic platforms, and also medicine delivery systems. Sustained by the current explosion in public interest and access to inexpensive printers, there is renewed rate of interest to combine stem cells with customized 3D scaffolds for customized regenerative medicine. Instances are highlighted to show development of each technology in tissue design, as well as essential constraints are recognized to encourage future study as well as advance this fascinating area of sophisticated manufacturing. Metal 3D printing, also known as additive production, encompasses innovations such as Direct Steel Laser Sintering as well as Electron Beam Of Light Melting. These procedures entail the layer-by-layer blend of metal powder to create complicated as well as practical components. Post-processing strategies are vital to attaining the preferred mechanical homes, surface finish, as well as dimensional precision of metal 3D published parts.

The layers will be separated or divided leading to a print that will certainly be weak or break. Some people have had good luck taking care of balls and zits in their 3D prints by simply updating or transforming slicers completely. It might be a way your certain slicer is processing documents that produce these blemishes. If your versions currently have stringing and you just wish to deal with that on the model itself, you can apply a warm weapon. The video listed below programs just how efficient they are for removing stringing from designs.

Innovations in 3D printing have made it simpler for developers and engineers to personalize jobs, develop physical models at various ranges, and produce frameworks that can not be made with more typical manufacturing methods.

Today Gambody intends to share tips on updating your 3D printer speed for faster printing without losing the top quality of the prints. Adding support, but some versions are specifically developed to not need assistances even when breaking this guideline. Another trick I found beneficial is to decrease the flow price for the supports.

In the images below, we have actually set out several of the a lot more magnificently complicated layouts developed making use of a 3D printing process called Laser Sintering. These 3D published designs are included, as well as yet the part can be built in a consolidated device. Via 3D printing, free-flowing, natural as well as complex styles are perfectly implemented while keeping toughness in methods difficult using any other production process. A couple of prototypes later as well as you as well as your team land on it, the ideal model.

Rhinoceros 3d Modeling Device For Fast Prototyping

Generally, the sheet lamination process utilizes paper, polymer, or thin sheets of metal for this procedure. One of the most typical handling modern technologies are Laminated Things Production and also Ultrasonic Loan consolidation which produces a great deal of waste and also need more processing of the component before use. Today, you can make use of extrude biomaterials, edible things, and also a variety of other products, but PLA, ABS, as well as various other plastics are one of the most typical.

” The chemical conversion of the material and all various other tests will certainly likewise need to be performed inside the chamber,” Momotenko explains. 3D printing is a broad term that makes up a collection of several various sorts of 3D printing as reviewed previously. Other co-authors are from Sungkyunkwan University and Digital Light Innovations.

Although the issue focuses on temperature level, there’s even more to the tale than just that. You can transform the handle counterclockwise to reduce the percentage and decrease the rate or clockwise to increase the speed. You can make changes throughout the printing procedure, so if you observe problems with the initial layer, attempt decreasing the price to 75% for a couple of layers, after that bringing it back to 100%. As soon as you make sure that the very first layers publish efficiently, you can look for under or over-extrusion. A reduced extrusion multiplier indicates you’ll see spaces in the print due to the fact that specific layers are smaller than they must publish. A high extrusion multiplier bulges layers due to the fact that there’s more filament than needed.

Exactly How To Take Care Of Component Of The Print/supports Moved Or Separated Totally

Printers and also products can vary from a print temperature level of 180 ° C to 250 ° C. Some products manage a vast array of temperature level, while others handle just a 5 ° variety. Some areas of the printed model are looking worn-out, as well as the layers that don’t bond correctly can get pulled apart. In addition, the 3D-models can be fine-tuned in order to avoid development of assistances somewhat. Try decreasing the overhang angles and also changing the design so it will be effectively printed without supports.

Very energetic article, I enjoyed that bit.

Willl there be a part 2?

Grrat items from you, man. I’ve consider your sttuff peior to and you’re just

extremelyy excellent. I reallly like what you havee bought here, certainly

likke whzt yoou are stating annd thee wway wherein you

say it. Youu are making it enjoyable and youu conbtinue

too take cate off tto stay it sensible. I can’t wzit to learn far mor fom you.

Thatt is actually a greazt webb site.

Всем Доброго утра! Вот это меня улыбнуло!!!!

кто вызывал чёрно-белый кринж от Тони Шторм? Шторм винит во всём саму Шиду. Уайт провёл драгонскрю об канат, [url=http://kasimovhotel.ru/index.php?option=com_vitabook]http://kasimovhotel.ru/index.php?option=com_vitabook[/url] когда Бриско пытался вытащить его с апрона.

Yеsterday, while I was at work, mу cousin stole

mʏ iphone аnd tested to see if it can survive ɑ forty foot drop, just so she can bе

a youtube sensation. Ⅿy iPad is now destroyed and

she һаs 83 views. I knoԝ thiѕ is entirely օff topic

bսt I hɑɗ tο share іt ᴡith someone!

My page :: lotto

Excellent website. А l᧐t of helpful info һere.

I’m sending it to ɑ feԝ pals ans additionally sharing іn delicious.

And obѵiously, thаnks in your sweat!

my web blog: lotto

Aw, this ᴡas a very nice post. Finding the time and actual effort to create

а superb article… but what can I sаy… I procrastinate a lot and

neѵer manage to get nearlү anything done.

Also visit my blog poѕt – virtual sim number

Hiya very nice web site!! Man .. Beautiful .. Superb .. I will bookmark your site and take the feeds additionally?

I’m glad to search out numerous helpful information here within the put up, we’d like work out extra techniques on this regard, thanks for sharing.

. . . . .

Are you the form of one that goes to a club looking to have a one evening stand?

Most of the website that were visited by the held-hostage machines had been sites that users would by no means go to.

israelmassage.com

Hi there, just became aware of your blog through Google, and found that

it is truly informative. I’m gonna watch out for

brussels. I’ll appreciate if you continue this in future.

A lot of people will be benefited from your writing. Cheers!

Thanks for the marvelous posting! I truly enjoyed

reading it, you can be a great author. I will make sure to bookmark

your blog and will come back someday. I want to encourage you to ultimately continue your great work, have a nice weekend!

Thanks designed for sharing such a nice thought, paragraph is

pleasant, thats why i have read it completely

my web page; zimmermann01

You need to be a part of a contest for one of the highest quality sites on the net.

I will recommend this site!

Incredible! This blog looks exactly like my old one! It’s on a

totally different subject but it has pretty much

the same page layout and design. Superb choice of colors!

This piece of writing is truly a fastidious one it helps new

internet users, who are wishing for blogging.

I would like to thank you for tһе efforts

yօu һave рut in writing thiѕ website. I really hope to check оut

the ѕame hіgh-grade blog posts fгom you ⅼater on aѕ weⅼl.

In truth, your creative writing abilities һаs motivated mе to gеt my vеry ᧐wn site now 😉

Check out my pagе … slot (Katherina)

Tribedoce injection https://tinyurl.com/yuph9vpu

You really make it seem so easy with your presentation however

I to find this topic to be actually something which I think I’d never understand.

It seems too complicated and extremely extensive for me.

I am looking ahead to your next submit, I’ll try to get the hang of it!

Nonetheless, a lot more research is needed to confirm that biofeedback treatment can really make a long-term distinction in dealing with bruxism and jaw clenching. Stress and anxiety are significant contributors to jaw rigidity. Squeezing the jaw is a typical unconscious response to unsettling scenarios, or worse yet, persistent tension. Recurring anxiety can have damaging effects on not only dental wellness but the whole body.

These might likewise be a great option for individuals that are afraid of oral work, because a compound can be bonded in place, which implies much less exploration. As the tooth cavity advances, it invades the softer dentin directly underneath the enamel, and encroaches on the nerve and blood supply of the tooth had within the pulp. Gold and gold alloy crowns have been offered for countless years. Dental fillings for kids take concerning the same amount of time as they provide for grownups, with some additional considerations.

Tooth Sensitivity After A Dental Filling

A greater emphasis on preventive dentistry has helped in reducing the occurrence of early missing teeth. Given that we can’t eliminate the germs that are in the mouth, restricting the amount and frequency of sugars and starches in our diet plan is the most convenient way to avoid dental caries. A dental practitioner can discover a dental caries by using a sharp instrument to feel tooth structure that has actually been softened by tooth decay.

According to ADA, tooth cavities are a lot more common among youngsters, yet aging can be an essential issue for adults. Oral Care Facility write-ups are evaluated by an oral health medical professional. This content is not meant to be a substitute for professional clinical advice, medical diagnosis or therapy. Constantly seek the advice of your dentist, medical professional or other certified healthcare provider. Once a tooth is infected, it’s more expensive to fix and the danger of losing the tooth completely is higher.

Plymouth Dentist Phone

Teeth grinding can cause level of sensitivity and also even crack teeth. If this holds true, typically one of the most delicate teeth are your back molars or premolars. And also typically, reduced teeth are not influenced, just top teeth in these areas. You can use pepper mint tea bags to decrease tooth hurt and calm delicate periodontals. To do this, let the utilized tea bag cool prior to utilizing it to the affected area. Clove has actually traditionally been made use of to treat tooth pain since the oil can properly lower inflammation as well as numb pain.

Pain after a filling is uncommon, but it’s more probable you’ll experience tooth level of sensitivity for a day or two. Particularly, lately filled teeth can be conscious cold and hot foods and drinks. If you discover this problem, avoid these triggers for numerous days and see if the level of sensitivity lowers. However, this dental loading material isn’t fairly as resilient as amalgam. It, therefore, might not be suggested for deep dental fillings and those on attacking surfaces.

Glass Ionomer

Make fluoride your close friend by consuming fluoridated water and cleaning with fluoride toothpaste two times daily. It’s an excellent concept to call your dental professional if that discomfort continues for greater than a week. Teeth Image The teeth are the hardest materials in the body. See a picture of the Teeth and learn more regarding the health topic. If anti-biotics are required, tetracycline should be avoided due to the fact that it will certainly trigger discoloration in the child’s creating teeth. Ceramic dental fillings are visually pleasing and immune to staining.

The authors of a 2011 research study ended that allicin has antimicrobial buildings as well as might assist eliminate germs that can bring about oral diseases, such as Streptococcus mutans. Garlic is a conventional solution for a variety of wellness conditions. One use of garlic in herbal remedies is to deal with tooth pain. A 2006 research contrasted clove gel with topical benzocaine, which is a gel that dental experts typically utilize to numb a person’s gums prior to placing needles. The outcomes suggested that clove gel might be as reliable in relieving needle pain as benzocaine gel.

Fluoride

We additionally proudly offer the patients coming from nearby communities, consisting of Tempe, Mesa, and Phoenix. W Felix Peng DDS, is one of the subject cosmetic dental expert in Los Angeles. He is the proprietor of Peng Dental Care located in Los Angeles. The appearance of your teeth is all you require to be the person with the right and also brilliant smile.

Today, you can get various kinds of dental caries dental fillings depending upon the afflicted location, your spending plan, and choice. No two mouths are the same, and each dental scenario is unique. Thus, it isn’t feasible to offer thorough recommendations or identify oral conditions based on write-ups alone. The most effective means to ensure you’re obtaining the very best dental care possible is to check out a dentist personally for an evaluation and appointment. Dental fillings are an effective and affordable way to repair minor cavities. Prior to having a filling up done, talk to your dentist about the most effective choice for your situation.

Thank you for every other fantastic post. The place else may anybody get that type of information in such an ideal approach of writing?

I have a presentation next week, and I am at the search for such information.

Great blog right here! Also your site rather a lot up

fast! What web host are you the usage of? Can I am getting your affiliate hyperlink to your host?

I want my web site loaded up as quickly as yours lol

At this time I am ready to do my breakfast, later than having my breakfast coming yet again to read other news.

Also visit my blog post; خرید بک لینک

для общего развития посмотреть мона, а так могли бы и лучьше,

у подобного индивидуума постоянно изменяется настроение, [url=http://dedmorozural.ru/users/uvylujuw]http://dedmorozural.ru/users/uvylujuw[/url] и КПД его деятельности падает к минимуму.

Heya i am for the first time here. I found this board and I find

It truly useful & it helped me out a lot. I hope to give something back and help others like

you aided me. https://Kaidan136.com/index.php?title=%E5%88%A9%E7%94%A8%E8%80%85:JuniorWinters

Your style is unique compared to other people I’ve read stuff from.

Thank you for posting when you have the opportunity, Guess I will just

book mark this page.

– Quality

The Internal Control service for goods and an open forum for

all chemists and their training allowed Mega to provide only the highest quality

and selected varieties of goods.

mega sat site mirror working

Always look for the guidance of your dental practitioner or various other qualified doctor with any kind of inquiries you might have concerning a medical condition or treatment. If a loading becomes used, broken, or loose, it might no more work in safeguarding the nerves under the area of dental cavity. Prevent or limit acidic items, such as food or drink with a high focus of tomatoes, oranges or lemons.

Teeth Conscious Chilly: Reasons And Also Treatment

If your tooth origin has actually lost periodontal cells, a percentage of periodontal cells can be taken from somewhere else in your mouth and affixed to the afflicted website. Therapies are available for any type of immediate pain that you may be feeling, as well as adopting a healthy and balanced dental treatment routine can assist prevent even more sensitivity from developing. If you more than 40, maybe that your gums are revealing indications of wear and tear by pulling away from your teeth and also revealing your tooth origins. Those origins do not have enamel to protect them, so they’re much more sensitive than the remainder of your tooth. The bright side is that tooth level of sensitivity is often responsive to treatment.

In order to do this, it’s important to recognize what is causing your tooth level of sensitivity. Most cool level of sensitivity reoccurs, depending upon what creates it. Usually talking, it will generally diminish in a matter of seconds yet after that flare up any time your teeth are exposed to chilly temperatures once more. Your dental practitioner can deal with you to change your oral health habits and also prevent more damages from happening. This begins by avoiding foods and beverages that are known to cause enamel loss, such as those with a lot of acid and also sugar. If you do believe you’re grinding your teeth, contact an oral specialist ASAP.

I’m a dentist – here’s 5 DIY tricks to whiten your teeth and the truth about the kiwi trend… – The US Sun I’m a dentist – here’s 5 DIY tricks to whiten your teeth and the truth about the kiwi trend….

One teaspoon of dried out peppermint leaves can be put in a cup of boiling water and steeped for 20 minutes. After allowing to cool, it can be swished around in the mouth then spat out or swallowed. If toothache pain lasts greater than 1 or 2 days after that seeing a dental professional is suggested. The alcohol will certainly numb the pain for some time, and antioxidants in the vanilla may aid it heal. Utilize your finger or a cotton round to put a small amount on your aching tooth and gum.

Periodontal Illness

If your ache is caused by gingivitis, this is just one of the most effective ways to relieve the pain. Brush your teeth for a number of mins, concentrating on the agonizing area. Maintain brushing until the location no more really feels as delicate. Sweep it back and forth across the tooth to ensure that it gets any type of particles that have lodged there. See a dental expert immediately if you have a toothache. Tooth cavities happen when acids and germs break through the enamel and eat away at the delicate cells inside the tooth.

Hydrate the tea bag in warm water and apply to the afflicted location, or stick the moisturized tea bag in the fridge freezer to chill it first. Self-made hydrogen peroxide mouth wash functions a whole lot like a deep sea rinse to eliminate swelling and swelling brought on by bacteria. Your dental practitioner will certainly use X-rays and a physical exam of your teeth to detect dental cavity or other dental problems. And they may provide you discomfort drug and antibiotics to deal with an infection. Applying ice to the afflicted location assists diminish blood vessels and decrease discomfort and inflammation. You can cover a bag of ice or frozen veggies in a clean towel, and after that hold it versus your outside jaw for around 20 minutes.

By creating a couple of healthy and balanced habits you can quit tooth sensitivity prior to it begins and also you may additionally have the ability to quit it from becoming worse. A tooth-friendly lifestyle consists of securing your tooth enamel, taking care of your periodontals, and also seeking any kind of needed expert dental treatment. Try the adhering to strategies to stop pain from tooth sensitivity. Having a sensitive tooth is a pretty usual trouble, however what does it mean?

What Are The Therapies For Sudden Tooth Level Of Sensitivity?

As soon as sensitivity creates, timetable an oral appointment so you can get the underlying issue treated prior to it leads to pulp troubles. If you have sensitivity without an oral issue, making use of a desensitizing tooth paste or fluoride therapy often addresses the trouble. Level of sensitivity could be triggered by a shed or loosened filling, a cracked tooth or a revealed origin surface. In healthy and balanced teeth, a layer of enamel protects the crowns of your teeth– the part over the gum line. Under the gum line a layer called cementum protects the tooth root. Your dental expert may carry out a root canal treatment to remove infected or irritated tooth pulp in the facility of the tooth where the nerves and capillary are.

Прекрасное современное инновационное оборудование, уникальные инновационные технологии, [url=https://saravanaelectricals.org/product/arteor-square-champagne-mechanism-25-a-socket-2-module-2/]https://saravanaelectricals.org/product/arteor-square-champagne-mechanism-25-a-socket-2-module-2/[/url] квалифицированные профессионалы и уютная обстановка позволили нам завоевать спрос и приязнь наших клиентов.

Hi! I know this iis kinda ooff topic butt I was wondering whuch blo

platform are you usijg forr thiks website?

I’m getting sick andd tired oof WordPress becausee I’ve had probpems witrh hackers aand I’m lkoking att alternatives forr anoter platform.

I ould bee awesome iif you coukd popint me inn tthe direction off a good

platform.

Yet with the increased use as well as applications we’ve observed in the last few years, these are now shown truths, and study individuals are even more thrilled about the advantages of additive than they were two years back. We have actually detailed the top 3 benefits companies report enjoying thanks to additive manufacturing. Download the 2021 survey record to discover the current state of the international 3D printing market. The concept is to dramatically reduce the pathways of the ions inside the battery throughout the billing procedure. To do this, the electrodes, which are presently flat, would have to have a three-dimensional surface area structure.

Raising your layer elevation will usually make it simpler to accomplish a great bond in between an infill layer and the border. Nevertheless, if you pick to do so, you should stay clear of a rapid increase in your layer elevation since it can lead to curling on smaller sized parts. Infill overlap is the location of the perimeter that overlaps with an infill layer. The overlap is essential in order to achieve far better strength in between the infill and the perimeter. You have most likely attempted your hand at making gears with abdominal muscle, just to discover that the material itself isn’t that well suited for equipments.

Although an optimal scaffold will certainly make up all these factors, challenges still exist with biomaterial choice as well as 3D shape uniqueness. Each biomaterial has particular product and also mechanical residential or commercial properties, refining approaches, chemical residential properties, cell-material communications, and also FDA approval. Typical manufacture methods to produce porosity as well as a series of pores dimension are gas foaming, solvent spreading with particle leaching, freeze-drying, as well as eletrospinning. While the microarchitecture in these methods is well-controlled and comprehended, the capacity to manage macroarchitecture with these techniques is limited to 3D shapes and also geometries identified by mold and mildews and also manual processing. The capacity to include interior style or rounded networks is also limited when making use of these methods.

Why Post-processing Is Needed In 3d Printing

Designers have created an extremely reliable method to paint intricate 3D-printed items, such as light-weight frames for airplane and biomedical stents, that can conserve suppliers money and time as well as … Researchers have developed an inexpensive recyclable support technique to minimize the requirement for 3-D printers to print inefficient assistances, significantly boosting cost-effectiveness as well as sustainability for 3-D … In addition, since the nozzles can be activated as well as off independently, an MF3 printer has integrated resiliency, making it much less prone to pricey downtime, Cleeman claimed.

I have actually gotten on a little bit of a mission to discover some really safe 3D printer material, and also I’m not exactly sure there’s in fact such an item. Klipper is an extremely powerful firmware enhancement to most 3D printers. This advice can occasionally be important, specifically to those brand-new to 3D printing, who may have never seen the failing modes described. There is one method to do so, and that’s by utilizing a troubleshooting overview. Occasionally filament can obtain curled up and also incorporated knots as well as if the extruder continues to draw as well as tighten up these knots it can lead to a breeze. Dismantling your hotend occasionally is the only way to eliminate a really unpleasant blockage.

In many cases, the issue appears due to incorrect positioning of the print, indicating that it will not have the ability to endure the peel strength. This will trigger the activity distortion which in its turn leaves you with one more trouble– the successive layers will be developed on the barrel user interface instead of print itself. This might be tricky, yet you are in fact able to create some openings on the print base as well as evade all the circumstances where sticking is triggered by excess surface contact and suction. You completed the printing and also the design looks stunning, however there still is a trouble. One more important factor for the issue is that the filament isn’t cooled down quick sufficient as well as is unable to sustain itself over an empty space. The fastest and also most noticeable solution would certainly be to just eliminate the strings yourself.

If you intend to publish with another size, such as 2.85 mm or 3.00 mm, you will certainly require to acquire the proper hardware to upgrade your system. Some additives aid dilute the primary material, minimizing the cost of the finished item. PLA filament has a low warm resistance and can end up being warped or flawed in high temperatures.

Metals & Steel Products

Before you pick the appropriate filament for your next work, you need to examine a few boxes. For example, along with knowing what you plan to construct, you also need to comprehend your printer’s abilities. Amphora is more of a specialist type of light-weight, impact-resistant, 3D printer filament. Common applications consist of mechanical parts and also other objects that require a product that is of superb strength, highly flexible, as well as sturdy. This is an artificial polymer that’s stronger and also much more resilient than abdominal and PLA– as well as cost-efficient. It’s also flexible, light, wear-resistant, and also less brittle than both ABS and PLA.

It has anti-bacterial buildings that protect against cavities as well as dental caries. Drink a glass of wheatgrass juice or mix 1 component of wheatgrass juice with 6 components of water as well as rinse the mouth with it or straight chew wheatgrass if contaminated. The strategy of making use of grease to get rid of pollutants is called oil pulling.

Researches show an inverse connection between eating foods high in vitamin D as well as calcium, like yogurt, and dental caries in kids. You can get vitamin D from milk products, like milk and also yogurt. That’s because cavities do not generally hurt until they obtain deep enough to affect the nerve below the enamel of the tooth. The first sign of pain could be sensitivity to chilly or hot foods. It can additionally seem like periodic toothaches that disappear with discomfort medicine, or perhaps staining of the tooth. Cavities begin with dental caries in your tooth’s enamel– the outer layer of your tooth, states Martins.

Children’s Oral Health And Wellness: How To Look After Your Kid’s Teeth

It is a great suggestion to brush and floss quickly later, maybe adhered to up by a good antibacterial mouthwash. The idea right here is to prevent sugar deposit from staying in your mouth and feeding the germs, which will certainly permit them to increase and also spread. You can brush with Neem sticks or eat on the leaves or seeds to damage cavity-causing germs. The powerful oil in this plant has a long background as a solution for oral infections, dental caries, and for stopping blood loss and aching gums. All over India Neem twigs are used as chewing sticks to lower oral microorganisms and also normally tidy and also whiten teeth as well as also fight foul-smelling breath. Brushing and flossing are the tried and also evaluated approaches of keeping cavities away.

The deposits boost with inadequate oral self-care or neglect. Brownish stain is mainly caused by cigarette smoking or eating tobacco, hookah, and cannabis use1-4. Removal is completed with powered and hand-operated instrumentation in addition to polishing.

Coconut oil is a popular option for oil pulling, but you can likewise utilize other oils like sesame or olive oil. This article is intended to advertise understanding of and knowledge regarding general oral wellness topics. It is not planned to be a replacement for specialist guidance, medical diagnosis or therapy.

Instead, this is the real root of the natural herb itself from which the sweet is seasoned. Dental cavity occurs when foods including carbohydrates, such as breads, cereals, milk, soda, fruits, cakes, or candy are left on the teeth. Germs that reside in the mouth digest these foods, transforming them right into acids. The bacteria, acid, food debris, as well as saliva integrate to create plaque, which clings to the teeth. The acids in plaque liquify the enamel surface of the teeth, creating openings in the teeth called cavities. Adjusted with permission.On one group are oral plaque– sticky, anemic film of bacteria– bonus foods as well as beverages that contain sugar or starch.

Cavities/tooth Degeneration

Occlusal dental caries, or cavities on back teeth could be full of more-durable products, gold and silver being 2 choices. Based upon the extent and also area of your tooth cavity, your dental expert will certainly understand which is the most effective option for treating your cavities. Rather than treating dental cavity with expensive dental professional check outs, you can protect against dental cavity through cost-effective, all-natural means. All-natural avoidance approaches consist of a correct dental hygiene routine, certain important oils, certain dietary changes, and extra. A dental caries is a broken area on your enamel that can eventually become a little opening. Tooth cavities have lots of reasons; several of the most common include bacteria, overindulging in sugary treats and also drinks, and also not maintaining your teeth clean.

Enamel disintegration creates demineralization and tooth decay. After a cavity has actually created, the only efficient method to recover tooth cavity pain is through remediation treatment. Just how your dental professional will repair your cavity depends on the intensity.

What’s Inside Our Mouths?

Nonetheless, house treatment and natural home remedy can avoid tooth cavities from happening. Natural home remedy should be made use of alongside dentist-recommended techniques, such as brushing, ideally with a high fluoride tooth paste. Diet regimen, specifically the consumption of free sugars, is amongst the leading causes of dental caries. Sugar mixes with microorganisms in the mouth and also develops an acid, which puts on down tooth enamel.

Swishing some mouth wash around in your mouth as well as calling it a day isn’t a fail-safe means to avoid cavities. Rather, you need to ensure to eliminate all of the food as well as any plaque that’s built up between your teeth. A 2020 review suggested oil drawing with coconut oil could help enhance oral health and wellness as well as oral health.

It’s hard to come by experienced people about this topic,

however, you seem like you know what you’re talking about!

Thanks

I don’t know whether it’s just me or if perhaps everybody else experiencing

problems with your blog. It appears as though

some of the written text within your posts are running off the screen. Can somebody else please provide feedback and let me

know if this is happening to them too? This may be

a issue with my internet browser because I’ve had this happen previously.

Cheers

Appreciation to my father who stated to me regarding this blog, this webpage is truly remarkable.

Outstanding quest there. What occurred after? Thanks!

Feel free to surf to my blog post … สล็อตเครดิตฟรี

I do accept as true with all the concepts you have introduced to your post.

They are really convincing and can definitely work. Still, the posts

are too brief for novices. May you please extend them a little from

next time? Thanks for the post.

Just wish to say your article is as astounding.

The clearness to your publish is just spectacular and i can assume you’re knowledgeable in this subject.

Fine with your permission allow me to grasp your feed to stay updated with approaching post.

Thank you one million and please continue the enjoyable work.

I am sure this paragraph has touched all the internet people, its really

really good article on building up new website.

Hello! Would you mind if I share your blog with my zynga group?

There’s a lot of folks that I think would really appreciate your content.

Please let me know. Many thanks

Hey would you mind stating which blog platform you’re working with?

I’m looking to start my own blog in the near future but I’m having a difficult time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and I’m looking for something completely unique.

P.S Sorry for being off-topic but I had to ask!

The amount of time it takes for CHX to be utilized and the temperature level of the rinse are 2 possible danger aspects for CHX discoloration. Moreover, a regular use of CHX has been connected to a rise in tartar on the teeth. It is as a result critical that you take preventative measures to avoid tooth staining as well as tartar accumulation.

Oral chlorhexidine mouth rinses are normally recommended by dentists and clinical doctors to treat as well as stop gingivitis, which triggers inflamed as well as puffy gums. Chlorhexidine’s antibacterial buildings are effective against gingivitis, however they can additionally trigger tooth discoloration, equally as they are effective versus gingivitis. This discoloration is triggered by the communication of the di-cationic antiseptic and also dietary chromogens, causing a discoloration of the enamel.

Keep in mind that identifying the reason for your discoloration will certainly assist you locate the most effective service. The buildup of tartar on and also in between teeth is typically the outcome of a lack of brushing as well as flossing on a regular basis. It can likewise work as an alert you are developing gum condition. Results from in-office expert whitening treatments normally last around three years.

When To Consider Restorative Oral Job

A tooth abscess must be dealt with by a dental practitioner, yet some natural home remedy can soothe the pain caused by the infection. Whitney is a signed up oral hygienist that is likewise referred to as the “Teeth Talk Lady” on social media. Whitney’s journey of spreading out oral wellness recognition began on the YouTube platform– where she remains to create instructional videos for the general public. She is extremely passionate concerning sharing details concerning the relevance of dental health and wellness. Drugs like tetracycline generally aren’t suggested as usually because of their history of causing unsightly tooth tarnish. Dental experts can assist treat white areas with material infiltration or by bonding over them, if serious.

Insurance usually pays a part of the down payment and spreads the remainder of the benefit throughout the treatment period. The total amount covered by insurance is typically subject to an optimum benefit, so consult your insurance service provider to determine your coverage ceiling. Some of the means consist of orthodontic insurance policy, nonprofits, or dental discount strategies. They additionally offer teeth whitener, and the HyperByte, which is an exclusive high-frequency vibration tool which has actually been proven to reduce your aligner treatment time in half. So if your treatment time would’ve been six months, with byte it would now be simply three months on average for light and moderate instances. Upon finishing therapy, byte supplies a retainer for night time wear to protect your financial investment.

Karjaa Auto Rental Web Link Choices

Like other insurance companies, regular monthly prices and protection differ by degree. If your insurance provider supplies protection for adult dental braces, inspect the yearly optimum benefit or lifetime maximum for braces. Some oral policies pay a portion of the dental professional’s costs, while others cover a level charge. Scottsdale braces, comparable to risas braces, use an interconnected system of braces and cords to carefully move teeth gradually. During regular office gos to, your dental braces are adapted to work on aligning your teeth.

Teeth level of sensitivity is extremely usual in adults and young people. Teeth level of sensitivity is happened because of many troubles yet if you heal it quickly it will certainly not the irreversible problem. Is the main inquiry of everyone because in a current period virtually everyone is suffering from this type of problem. The main reason is that the food which is not risk-free and healthy for us and also it damages teeth and likewise wellness. Oral level of sensitivity can additionally be a sign of other issues, consisting of dental caries, periodontal disease or a cracked tooth. Teeth sensitivity typically happens when the underlying layer of your teeth– the dentin– comes to be subjected.

Easy Home Remedies To Get Relief From Delicate Teeth

Dentin is a hard, permeable tissue that lies beneath the layer of enamel in all teeth. An individual can decrease the danger of tooth dental caries by using a fluoride tooth paste. Individuals have actually long used clove oil as an individual remedy for toothache. Research study suggests that there is even more to this than just practice. A cool compress is an attempted and checked method for quick, short-term remedy for oral discomfort.

can be reversed by taking steps toward good dental health. Throughout early demineralization, direct exposure to fluoride, daily brushing and flossing, as well as regular cleanings can all help protect against & #x 2014; or even reverse & #x 2014; dental caries.

Guardian uses a Benefit Gold plan that includes a huge network of dental practitioners and thorough advantages, consisting of orthodontics and dental braces. Oral and orthodontic insurance coverage has a great deal of limitations, like life time limitations, yearly optimums, and waiting periods. You may still pay a great deal for dental braces, even if you get orthodontic insurance. If you’re set on getting clear aligners as opposed to conventional dental braces, you may have the ability to discover an insurance strategy that partially covers the expense. To make use of DentalPlans, you’ll enter your location information and browse readily available plans.

I used to be able to find good info from your articles.

Your means of describing all in this piece of writing is

genuinely nice, all can simply be aware of it, Thanks a lot.

My brother suggested I would possibly like this web site. He used to be totally right.

This put up actually made my day. You can not imagine simply how much time I had spent

for this info! Thanks!

Hey very nice blog!

Ꭲake a looқ at my web blog :: lotto

Good info. Lucky me I came across your website by accident (stumbleupon).

I’ve book-marked it for later!

Hello friends, how is everything, and what you wish for to

say concerning this post, in my view its truly amazing for me.

Thanks for sharing your info. I really appreciate your efforts

and I will be waiting for your next write ups thank you once again.

Ϝirst of all I want to say excellent blog! Ӏ һad a quick question which I’d lіke tо ask if

you dοn’t mind. I wаs inteгested tо know hoѡ you center yoursеlf аnd cleaг yοur

head Ьefore writing. І havе һad trouble clearing my thօughts in getting my ideas оut theгe.

I tгuly do enjoy writing but іt jᥙst seems likе the fіrst 10

tо 15 mіnutes tend to be wasted juѕt trying to figure out how tօ begin. Any ideas or

hints? Apprecіate it!

Aⅼѕo visit mу homeрage … casino

To treat it, your dental professional might do a deep tidy of your teeth, called planing or scaling, that scrapes tartar as well as plaque listed below the gum line. You can likewise require medication or surgical treatment to fix the problem. Since your tooth enamel safeguards the nerves in your teeth, take care to avoid needlessly damaging it. The following methods assist you safeguard and also maintain your tooth enamel. When the pulp tissue inside a tooth is dying– normally as the result of a terrible injury or blunt pressure– the nerve typically goes through phases of severe sensitivity.

Cleaning twice a day and also flossing once a day removes plaque as well as food particles from your teeth, avoiding the development of germs that creates cavities. When cleaning, use fluoride toothpaste and also a soft-bristled brush to gently clean your teeth and gum line. Tooth cavity is a long-term damage to the difficult surface area of your teeth triggered by bacteria and decay in holes or openings. Anyone can obtain a tooth cavity, but people who snack commonly as well as have a tendency to consume alcohol sugary beverages go to higher danger for creating one. As time passes, they end up being bigger and also deeper and affect other layers of the teeth. Ultimately, this decay can lead to extreme toothaches, infection, and possibly, loss of the tooth entirely.

Exactly How To Get Rid Of Cavities: 9 Home Remedies + Avoidance

Nevertheless, residence treatment as well as natural remedy can protect against tooth cavities from occurring. Home remedies should be utilized alongside dentist-recommended methods, such as brushing, preferably with a high fluoride toothpaste. Diet plan, especially the intake of free sugars, is amongst the leading causes of dental caries. Sugar mixes with bacteria in the mouth as well as forms an acid, which puts on down tooth enamel.

Another source of tooth level of sensitivity is splits in the tooth’s enamel surface. Extreme temperature modifications cause teeth to broaden as well as agreement. With time, tiny fractures may establish, enabling hot or chilly feelings to seep via to the nerves below the tooth enamel. While this might seem like a considerable treatment, it’s considered the most successful technique for getting rid of tooth sensitivity. While evaluating the seriousness of your tooth sensitivity, it is necessary to take into consideration not only exactly how strong the discomfort is, however just how frequently it takes place.

Anyone that has actually managed the pain of a delicate tooth understands it’s no enjoyable. But to you, chilly sensitivity and the resulting tooth discomfort is impossible to neglect until it lastly disappears. Tooth sensitivity refers to discomfort that occurs when a substance touches your teeth. Sugary, warm, as well as cold foods and drinks usually set off the pain. If you seem like you have tooth level of sensitivity to cool or a tooth sensitive to warm, after that you can inspect or determine the reasons for tooth level of sensitivity to cold as well as warm in this area. Only make use of a soft bristle brush as well as do not brush your teeth as well strongly.

When a tooth cavity is simply beginning to develop, you may be able to reverse it by cleaning several times a day with a fluoride tooth paste. However if the tooth cavity has actually expanded and has actually been there for a while, the brief response is you really can’t make it disappear. Pain from a dental caries can fade, which can make us think the dental caries itself has vanished by itself but actually, this is because the tooth decay has actually caused nerve damage. The good news is, preventing dental caries is fairly basic.

Chew Sugar-free Gum Tissue

Eggshells consist of calcium that an individual can utilize to help remineralize the tooth enamel. It can additionally serve as an unpleasant cleaner to get rid of plaques. A 2018 research study on changed eggshell with titanium oxide composite protects teeth against acidic substances.

Tell your dentist if you have any history of hatreds medication. Your dental practitioner will discuss the risks and address any questions you have prior to waging any type of kind of sedation dentistry. Soon, you will be as well numb to feel any type of discomfort throughout implant surgical treatment or various other procedures, and the dental expert can after that proceed with the procedure. Its medicines and methods help to alleviate tension and pain during your procedures to ensure that you can obtain the high-quality oral treatment you. need (and should have!). Your dental expert will give you with a list of postoperative guidelines.

Rates are assured for one year for the plan benefits at first picked. Please refer to your strategy records for a complete listing of restrictions and exemptions. Even if your teeth are a different shade than someone else’s does not mean there’s something incorrect. But if you have discoloration that troubles you or makes you really feel awkward, a dental practitioner can assist you discover means to brighten your smile. Gray tooth staining may suggest that the nerve inside your tooth has passed away.

Sri Lanka is a fabulous place for journey. Discover historical temples, abundant jungles and also sandy beach fronts on this memorable island. Circumnavigate the nation is easy with cost effective trains, buses as well as long-distance taxis. Private vehicles are additionally available however are costly, https://blend.io/rihannaekaiser.

Wow, this post actually resonated with me. Your point of view is both informative and unique.

I am actually most definitely bookmarking this for future reference.

Here is my site … Ron Spinabella